Table of Contents

Brisbane’s beauty comes with a risk: it’s a city built on a floodplain. If you’re buying property here, understanding flood risk isn’t optional—it’s essential for securing finance, insurance, and peace of mind. As a trusted mortgage broker in Brisbane, we’ve helped hundreds of buyers navigate this process with confidence. This 2026 guide goes beyond the basics, showing you how to access your FloodWise Property Report, decode flood terminology, manage insurance costs, and take action if your property is wrongly classified.

Let’s dive in and learn how to make informed decisions about Brisbane properties and flood risk.

Quick Overview

- Brisbane is prone to flooding due to its location on a floodplain, with 177 suburbs affected in the 2022 floods.

- The FloodWise Property Report is a free tool from Brisbane City Council that assesses flood risk for specific properties.

- Key flood risk indicators include Annual Exceedance Probability (AEP), with 1% AEP meaning a 1 in 100 chance of flooding each year.

- There are four main types of flooding in Brisbane: river, creek, overland flow, and storm tide.

- Buying property in flood zones can be challenging – banks may limit loans to 80% of property value for medium-high-risk areas.

- Flood insurance is crucial and may be required by lenders, but premiums can be high in flood-prone areas.

- When considering a flood-affected property, assess insurance costs, previous damage, flood mitigation measures, and financing options.

- Resources like the Flood Awareness Map and FloodCheck Queensland provide additional information on flood risks.

- According to the Insurance Council Of Australia, the 2022 Brisbane floods affected 177 suburbs and approximately 23,400 properties, causing an estimated $2.5 billion in insured losses.

- Homeowners in flood-prone areas can implement various strategies to mitigate flood risks, such as elevating important systems and improving drainage.

- If you’re looking for a home loan, the team at Hunter Galloway – Mortgage Broker Brisbane can help.

Get Floodwise Report

FloodWise Property Report is based on information from the Brisbane City Council and models potential flooding risk based on the latest computer modelling.

To get the report, fill in your property’s details, including suburb, street name and number, on the Brisbane City Council Website. If you are in the Moreton Bay Region, you can also check the Moreton Bay Flood Check Report.

Important Note on Updated Flood Modelling: Following major flood events and a review in 2016, Brisbane City Council updated its flood mapping using more advanced modelling. This means some properties previously considered low-risk may now have a higher flood risk rating, which can impact insurance premiums and property development plans.

Reviewing Your FloodWise Report

Understanding Flood Levels

The flood levels in the FloodWise Property Report are based on the council’s predictive models and can potentially occur in any given year.

Key Information in Your Report

Your flood report provides crucial data on:

- Flooding risk, including flood planning areas for river and overland flow

- Coastal flooding hazards

- Historic flood levels, particularly from Brisbane’s 2011 floods

- Other potential water and flooding sources

- Minimum and maximum habitable levels

How To Check Flooding Zone In QLD For Free

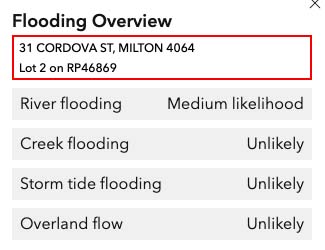

We’ll run through an example Flood Check Property Report for 31 Cordova Street, Milton.

If your property hasn’t been affected by flooding, the report will not show some of the sections below.

1. Are the property details correct?

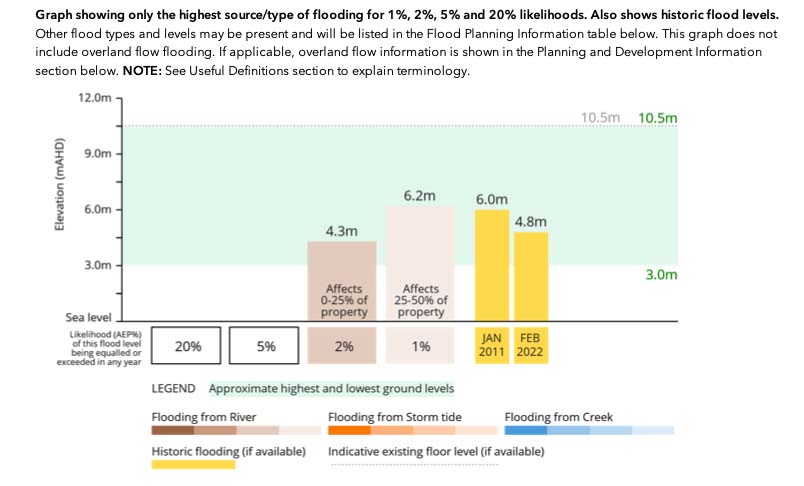

2. Flood Level Information

This shows where your property is placed compared to today’s minimum habitat flood level, where the January 2011 flood occurred and your chances of being flooded in any year.

The chances of being flooded are based on Annual Exceedance Probability (AEP). This represents the likelihood of a flood occurring in any given year. For example, a 1% AEP means there is a 1% chance of a flood of that size occurring in any given year.

Another way this is expressed is 1:100.

As you can see with this property, the chances are fairly high based on the council’s estimate of the property’s ground level.

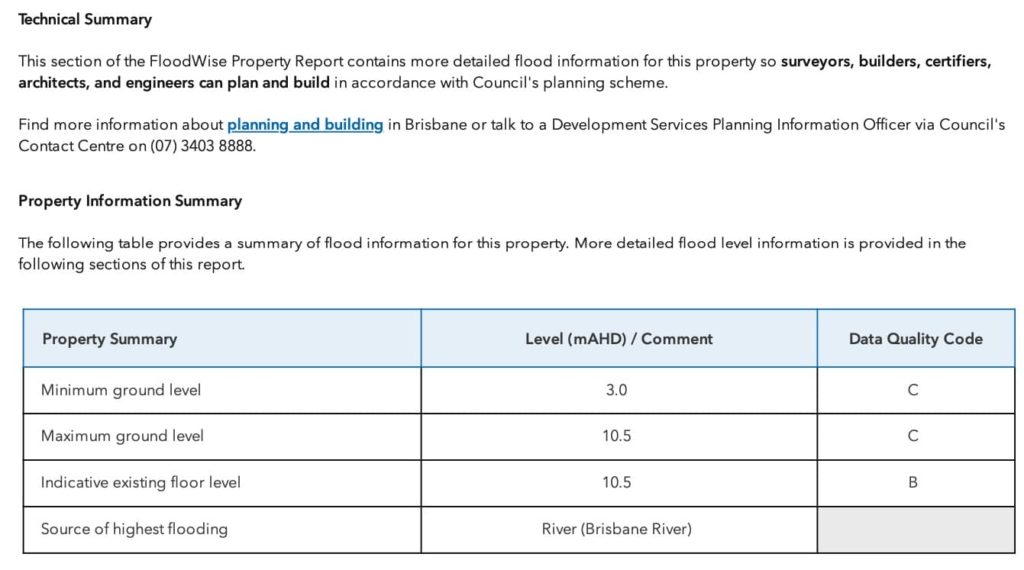

3. Technical Summary

The technical part of the FloodWise Report contains much more detail and has been created for builders, architects and engineers to take into consideration when building a new property.

Maps on the FloodCheck website can also show previous floods, like the Brisbane 2011 flood.

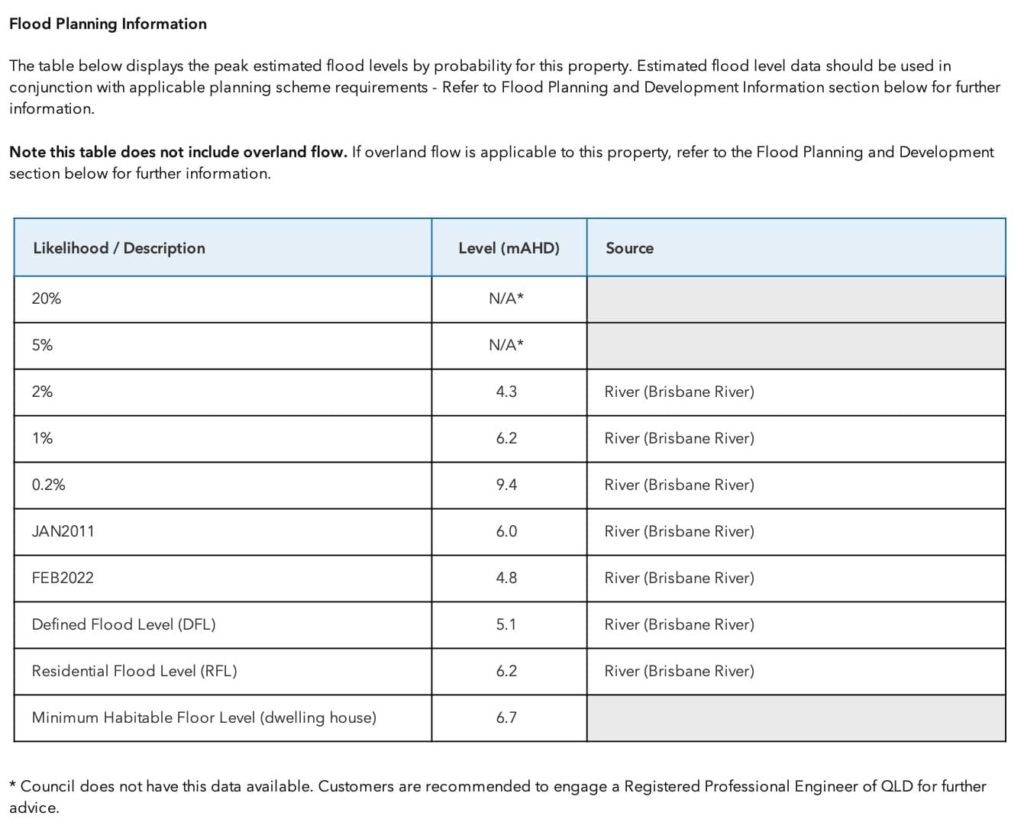

4. Estimated Peak Flooding Levels

Again, the estimated peak flood levels are mostly made for builders, architects, and engineers to ensure that any new properties constructed are built around the current planning scheme requirements.

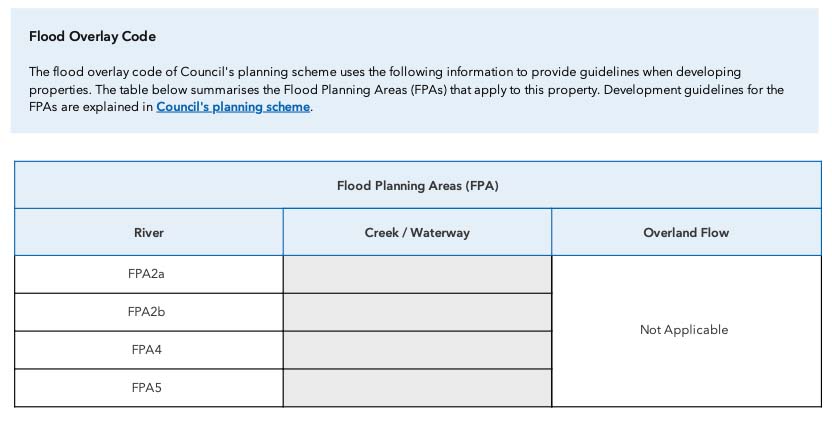

5. Flood Overlay Code

This section of the flood report details the specific type of flooding your property has been affected by. For example, this property is affected by FPA2a, FPA2b, FPA4 and FPA5.

This means that flooding is likely to be deep and moderately fast-moving water. So, in the worst-case scenario, if you ever had to rebuild the home, it would need to be constructed on stumps.

For more information on Flood Planning Areas, visit the Brisbane City Council or download the guide here.

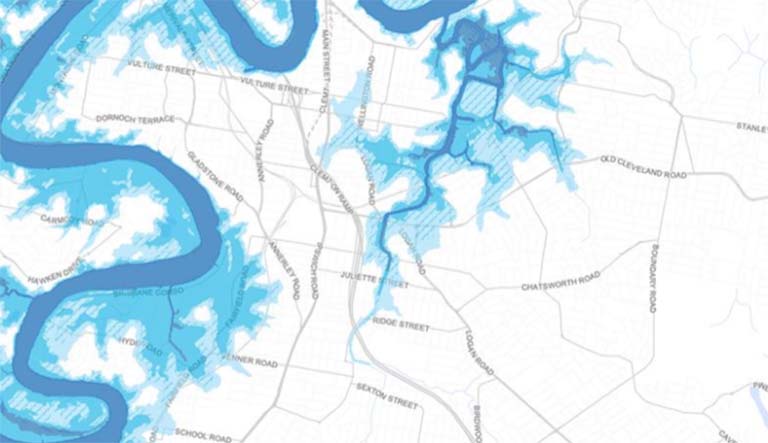

Using Flood Awareness Map In Brisbane

In addition to the latest data from the Brisbane River Catchment Flood Study and Perrin Creek and Moggill Creek flood studies, the newly updated Flood Awareness Map was made using the following information:

- 21 Hydrology models,

- 21 hydraulic models

- 1100 ground surveys.

- Surveys were also conducted at more than 550 locations

- Gauges in more than 450 locations were inspected.

- Surveyors recorded debris from 90 locations.

As you see, they did a pretty thorough job!

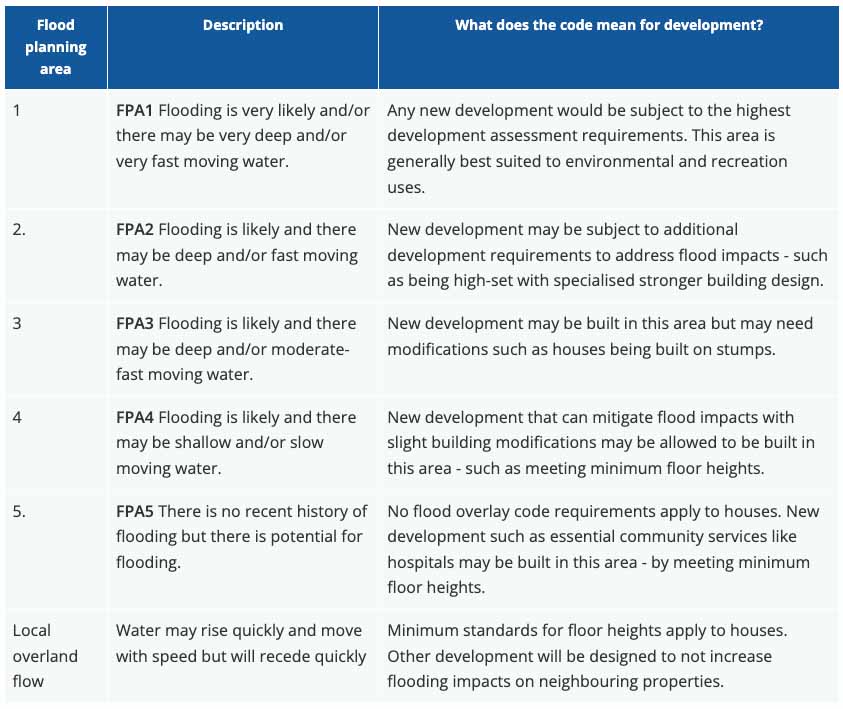

It breaks down the various likelihoods of flooding on your property, ranging from a high likelihood of 5% to a very low likelihood of a 0.05% chance of flooding occurring in any year.

- Very low likelihood (0.05% Annual Chance)

- Low likelihood (0.20% Annual Chance)

- Medium likelihood (1.00% Annual Chance)

- Medium-High likelihood (2.00% Annual Chance)

- High likelihood (5.00% Annual Chance)

This map also shows the flood sources and historic floods.

Flood sources can help with insurance. Sometimes, they will ask about the type of flood the property was affected by, such as river, creek, storm tide, or overland flow.

Historic floods show the water levels that were reached in the January 2011 flood in Brisbane and the January 1974 flood.

Comparing Flood Tools in Queensland

Here’s a clear comparison of the three flood-related tools mentioned—designed to help users decide which one suits their needs best:

Tool Name | Primary Use | Geographic Scope | Key Features |

Flood Awareness Map | Quick, general flood-risk overview | Brisbane City Council area | Search by address to view flood-likelihood zones (river, creek, storm tide, overland flow); shows historic flood events; simple visual interface. |

FloodWise Property Report | Technical, property-specific flood analysis | Brisbane City Council area | Downloadable report including flood-risk graph, historic flood levels (e.g. Jan 2011, Feb 2022), aerial map with 1% AEP extent, detailed metrics like habitable floor requirements, flood planning overlays, and technical data for building compliance. |

FloodCheck Queensland | Statewide flood-study mapping and imagery | Queensland (statewide) | Web map application showing where flood-studies exist, historic flood maps and imagery (e.g. 2012 flood); not suitable for assessing risk at the individual property level—it indicates study coverage rather than risk. |

How to Choose the Right Tool

- Just want a quick look at flood risk? Try the Flood Awareness Map—simple and visual.

- Need detailed, actionable info for construction or development? Go with the FloodWise Property Report—deeply technical and tailored to specific properties.

- Looking across Queensland for historic flood studies or imagery? Use FloodCheck Queensland, but remember it does not tell you if a property is at risk—only if it’s been studied.

Buying Property In A Flood Zone

You might have difficulty getting a home loan if you are looking at buying a home that is in a flood zone – but depending on your financial position, you might be able to still qualify for a loan.

The bank’s main concern is how often flooding happens. If your property is zoned to flood more than 1:100 or has a medium likelihood, 1.0% annual chance of flooding, the banks can struggle to give you a home loan.

How much can I borrow on a flood-affected property?

The table below provides a general guide to how lenders may view properties with different flood likelihoods. Policies are subject to change and vary significantly between banks. This is for illustrative purposes only.

Very low likelihood (0.05% annual chance) | Up to 95% of the property value |

Low likelihood (0.2% annual chance) | Up to 95% of the property value |

Medium likelihood (1.0% annual chance) | Up to 95% of the property value |

Medium-high likelihood (2.0% annual chance) | Up to 80% of the property value on a case by case basis |

High likelihood (5% annual chance) | In most cases we are unable to assist with finance on these properties |

Lenders can be more conservative with heavily flood-affected properties, so if your annual chance is 2% or more, we may need to get additional council records of a valuation report to make sure the lender can approve your loan.

Are there extra requirements from the banks for flooded properties in Brisbane?

Depending on the severity of flooding on the property, the banks can ask for more information than normal. This may include:

- You need to hold council approval if you are building on the property or if there is an existing house on the land.

- You need to be able to get home & contents insurance on the home

- The maximum height that flooding can reach must be under the floor level of the house.

- The bank will need a valuation completed, and their valuer must determine the property is not too risky for the bank.

We have helped customers get home loans approved based on a flood of 1:50 years, or a 2.0% annual chance. If you have enough of a deposit and can meet the above requirements, we may be able to negotiate a loan for you. You could also use it as a chance to negotiate a lower price with the real estate agent!

Brisbane Flood Zones

A total of 177 suburbs (out of 184) were affected by the 2022 flood, so understanding where the flood zones in Brisbane are is critical when buying a home.

A large portion of these areas is in lower areas, near the Brisbane River or creeks.

Flood Affected Suburbs In Brisbane

Acacia Ridge | Fairfield | Middle Park | Sinnamon Park |

Albion | Fig Tree Pocket | Milton | South Brisbane |

Anstead | Fortitude Valley | Moggill | St Lucia |

Archerfield | Graceville | Moorooka | Sumner |

Auchenflower | Greenslopes | Morningside | Taringa |

Balmoral | Hamilton | Mount Ommaney | Teneriffe |

Bellbowrie | Hawthorne | Murarrie | Tennyson |

Bowen Hills | Hemmant | New Farm | Toowong |

Brisbane City | Herston | Newstead | Wacol |

Brookfield | Highgate Hill | Norman Park | West End |

Bulimba | Indooroopilly | Oxley | Westlake |

Chapel Hill | Jamboree Heights | Paddington | Willawong |

Chelmer | Jindalee | Pinjarra Hills | Wilston |

Coopers Plains | Kangaroo Point | Pinkenba | Windsor |

Coorparoo | Karana Downs | Pullenvale | Woolloongabba |

Corinda | Kelvin Grove | Riverhills | Yeerongpilly |

Darra | Kenmore | Rocklea | Yeronga |

Durack | Kenmore Hills | Salisbury |

|

Dutton Park | Kholo | Seventeen Mile Rocks | |

East Brisbane | Lytton | Sherwood | |

Flood Terms To Understand

There are 4 main types of flooding that occur in Brisbane, ranging from river flooding all the way to storm tide flooding.

#1 - River Flooding

This happens when there is extended rainfall over the Brisbane River catchments, causing high amounts of water to rise and flow over the banks. Interestingly, River flooding downstream can happen several days after the rain has stopped!

#2 - Creek flooding

Creek flooding is caused by heavy rainfall but in creek catchments. More often than not, it flows very quickly and can cause flash flooding in very short periods around creeks and waterways.

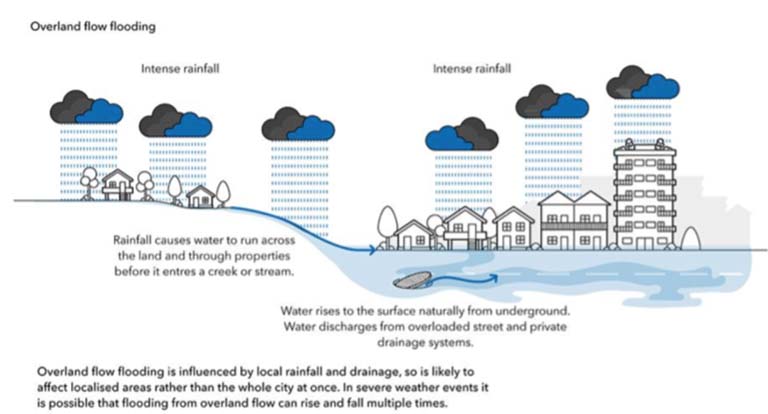

#3 - Local overland flow

It is localised flooding and the most common type of flooding in Brisbane. It happens when water runs across the ground and paths after heavy rain and can occur really quickly. It is sometimes unpredictable, as it can be affected by urban structures like fences and walls.

#4 - Storm tide flooding

This type of flooding happens when winds from a storm push the ocean towards the land, causing much higher-than-normal sea levels. The major risk from a storm tide or storm surge is increased during high tides and generally affects lower-lying areas close to shores and other waterways.

Flood Insurance Requirements

Your bank will need you to have home and contents insurance against your property, and it must specifically cover you for the risk of flooding. If you do not have the correct flood insurance cover, you can risk having your home loan declined.

Several insurance providers like Allianz and NRMA can offer flood insurance covering:

- Overland flow caused by high rainfall and nearby rivers

- Flooding caused by overflowing rivers and dams

- Sea level flooding caused by storms

The biggest difference between insurance providers is how they define storm and water damage, so chat to them about what policy will best suit you.

Flood Insurance Costs and What Affects Them

Flood insurance is more than just a checkbox—it can make or break your home loan approval. Here’s what you need to know.

How Much Does Flood Insurance Cost in Brisbane?

In Brisbane, flood insurance premiums vary based on your property’s flood risk.

For low-risk areas, you might pay around $1,000–$2,500 per year.

For homes in flood-prone zones, premiums can jump to $10,000 or more annually.

Insurers use historical flood data, elevation levels, and postcode risk to calculate costs.

Why Flood Insurance Is Non-Negotiable

Lenders usually require home and contents insurance that explicitly covers flood events. Without this, your loan could be declined—even if you’re fully approved otherwise. Banks often request proof of coverage before settlement.

What Affects the Cost of Your Premium?

Several factors drive your premium up or down:

- Flood likelihood: The higher the risk, the higher the cost.

- Property elevation: Lower homes attract steeper premiums.

- Flood mitigation: Improvements like raised services or flood barriers can reduce premiums.

- Claim history: Previous flood claims affect your future pricing.

- Type of flooding: Overland flow often costs less to insure than river or storm tide flooding.

Tips to Save on Flood Insurance

- Get multiple quotes from providers like Allianz, Suncorp, and NRMA.

- Increase your excess to reduce your annual premium.

- Ask your broker about properties that qualify for reduced-risk coverage.

- Bundle insurance policies for multi-policy discounts.

Talk to Your Mortgage Broker In Brisbane Early

It’s best to check insurance costs before making an offer. This way, you avoid surprises at the finance stage. Your mortgage broker can even refer you to flood-insurance-savvy providers.

What To Do If You Disagree With The Flood Risk Rating

Think your property’s flood rating is too harsh? Flood ratings affect more than insurance. They impact your borrowing capacity, property value, and ability to renovate or build. Here’s a way to fix it:

You Can Request a Technical Review

Brisbane City Council allows homeowners to apply for a technical review. This process helps update outdated or incorrect flood data tied to your property. If successful, your flood level or risk rating may improve.

What You'll Need to Challenge the Rating

To request a review, you’ll need:

- A site-specific survey from a licensed surveyor.

- A technical report from a registered professional engineer (RPEQ).

- Supporting documents that explain the discrepancy.

Submit everything through the Flood Information Online portal on the council’s website. It can take a few weeks, so plan ahead if you’re buying or refinancing.

Dealing With Flood Damage

During the Brisbane Floods of 2011, some of our clients’ homes were flooded in New Farm. Unfortunately for them, water entered the house in various ways, but the worst part was not the water itself, but the muck and mud that remained once the flood receded.

In our client’s case, and most cases with flooded property in Brisbane, a horrible smell was left from the mud and muck and the majority of the homes’ floors, internal walls (including plasterboard), and carpet had to be removed.

The flooding also destroyed some of their electrical and plumbing services, so they needed a brand new hot water system and the property rewired before moving back in.

Fortunately, they had insurance cover to protect them, but it took a substantial amount of work to make the home livable again.

As we said before, it’s worth considering the likelihood of your home flooding and the implications before going ahead.

What To Consider Before Buying Flood-Affected Property

While flood-affected properties may be cheaper, consider these crucial factors before signing a contract:

- Insurance:

- Can you get comprehensive home, contents, and flood insurance?

- What are the current insurance premium costs?

- Flood History:

- How severe was the previous flood damage?

- What type of flooding affected the property (river, stormwater, etc.)?

- Property Modifications:

- What flood mitigation measures have been implemented post-flooding?

- Financial Considerations:

- Will your bank approve a mortgage for this property?

- Have you asked your mortgage broker for an upfront valuation?

- Future Risks:

- What’s the likelihood of future flooding based on climate projections?

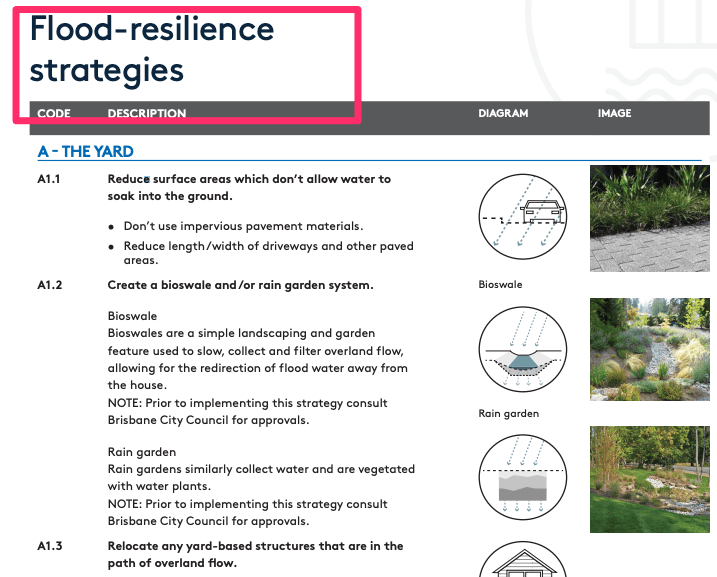

The owners of the property you want to buy may have followed the FloodWise Flood Resilient Homes Program, which has been designed to help people from Australia prepare, live through and return to normality after a flood.

Building Standards In Flood-Prone Areas

If you’re considering a knockdown-rebuild or major renovation in a flood-affected area, it’s important to know that building requirements are guided by the National Construction Code (NCC), administered by the Australian Building Codes Board (ABCB).

The NCC sets out minimum standards for construction in flood-prone areas, including:

- Habitable floor levels – must be built above the defined flood level to reduce risk.

- Structural resilience – buildings need to withstand flood forces such as fast-moving water and debris.

- Material requirements – use of flood-resistant materials in lower parts of the building.

- Access and egress – safe evacuation routes during a flood event.

For buyers, this means that rebuilding or significantly renovating in a flood zone may come with extra compliance costs and stricter design rules. Always check your FloodWise Property Report alongside the NCC guidelines before making major property decisions.

Resources To Keep Up To Date With Flood Warnings

Floods can cause devastation to public transport and roads for months after an event. After the 2022 Brisbane flood, the government said it could take weeks to get the ferry network back online.

If you do get impacted by a flood, it is best to keep up to date with the latest updates and timetables from the government services:

- Translink’s website, Twitter and Facebook

- The Bureau of Meteorology’s Queensland warnings page and its Queensland Twitter and Facebook

- Brisbane City Council’s Twitter and Facebook

- Queensland Fire and Emergency Service’s website

- Qld Traffic

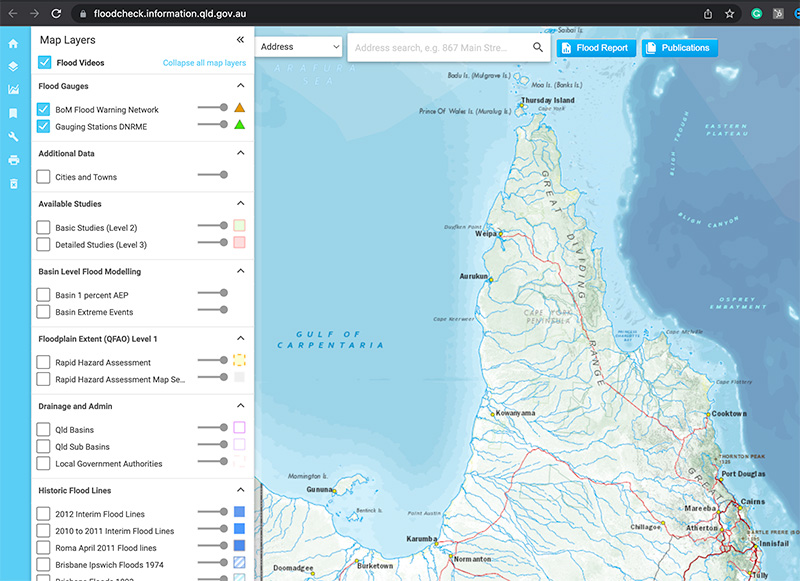

Bonus: Using FloodCheck Queensland Map

Over the years and throughout multiple floods, Brisbane wasn’t the only area affected in Queensland. There were major flood warnings for Ipswich, Logan, Brisbane and Gympie.

In 2022, Gympie recorded its highest flood in a century, affecting up to 3,600 homes. You can use FloodCheck Queensland to see if a property has been affected across the state.

It gives useful map overlays like the 2012 flood imagery and information on the Brisbane Ipswich floods of 1974.

For more information, visit – https://floodcheck.information.qld.gov.au/

Bonus: Brisbane Flood Statistics: 2011 vs. 2022

(Source: Brisbane City Council & Insurance Council of Australia)

| 2011 | 2022 |

Suburbs affected | 94 | 177 |

Total properties affected | 14,100 | 23,400 |

Flood damage | $2.38 billion | $2.5 billion |

Brisbane river flood peak | 4.46m | 3.8m |

People affected | 200,000 | 500,000 |

Frequently Asked Questions (FAQs)

How to check flood history on a property?

You can check a property’s flood history through the Brisbane City Council’s Flood Information Online portal. Simply enter the property address to access flood reports, mapping overlays, and historic flood levels. These tools will show whether a property has been affected by overland flow, creek flooding, or river flooding. For a detailed record, you can also request a FloodWise Property Report.

Which suburbs in Brisbane are flooded?

Some Brisbane suburbs historically prone to flooding include Rocklea, Fairfield, Graceville, West End, and New Farm. Areas near the Brisbane River and its tributaries are generally at higher risk. Suburbs like Oxley, Yeronga, and Chelmer have also experienced major flood events. Always check a property’s flood risk before buying or renting.

What is the flood website for Queensland?

Queensland’s official flood information is available at the Queensland Government’s FloodCheck website and the Brisbane City Council Flood Information Online portal. FloodCheck provides statewide data, mapping tools, and alerts. The BCC portal focuses specifically on Brisbane properties, offering localised flood risk data and reports. Both are free and open to the public.

How to find flood history of a property in QLD?

Use the Queensland Globe or your local council’s flood mapping tool to search your property. For Brisbane addresses, the FloodWise Property Report is the most detailed option. It outlines historical flooding, flood types, and predicted flood levels for planning. Contact your local council if you need clarification or can’t access the data online.

What is the flood property report in Brisbane?

The FloodWise Property Report is a free online tool by Brisbane City Council that shows flood risk information for individual addresses. It includes flood levels, risk ratings, and flood planning data like minimum habitable floor levels. This report is often required when applying for a building approval or home loan. It’s also a vital tool for buyers to understand potential insurance and resale risks.

How to tell if a house is in a flood area?

You can use Brisbane’s Flood Information Online or the Queensland FloodCheck website to check if a property is flood-affected. Enter the address and review flood overlays and past events. Check if the house is within a 1-in-100-year flood zone or subject to overland flow. A local mortgage broker or property lawyer can help interpret the results.

Why is Brisbane prone to flooding?

Brisbane is built around the Brisbane River and several smaller waterways. Its subtropical climate brings heavy rainfall and severe storms, particularly during summer. Urban development and historical planning near floodplains increase the flood risk. The city has also experienced intense weather from La Niña events and cyclones.

What year was Brisbane's worst flood?

Brisbane’s worst recorded flood occurred in January 1974, when the Brisbane River overflowed due to Cyclone Wanda. Around 8,000 homes were damaged, and over 14 people died. In 2011, another major flood hit, affecting more than 20,000 homes and businesses. More recently, in 2022, widespread flash flooding again impacted thousands of residents.

Is Brisbane prone to tsunamis?

No, Brisbane is not considered at high risk for tsunamis. The city’s eastern coastline is protected by the Great Barrier Reef and continental shelf, which absorb much of the tsunami energy. However, emergency services still monitor potential threats as part of Australia’s national tsunami warning system. Brisbane’s main natural disaster risks are floods and storms.

Is flood insurance mandatory or optional?

Flood insurance is typically required by lenders if the property is located in a known flood zone. For all other properties, it’s optional but highly recommended, especially in Brisbane. Many standard home insurance policies exclude flood cover unless added as an extra. Always confirm with your insurer before finalising your policy.

What does standard vs flood cover include?

Standard home insurance usually covers storm damage, hail, fire, and theft—but may exclude flood damage. Flood cover protects against riverine flooding, overland flow, and sometimes storm surge, depending on the policy. Some insurers define flood differently, so read the PDS carefully. It’s often an optional extra that increases your premium.

Can properties in flood zones be insured or mortgaged?

Yes, properties in flood zones can be both insured and mortgaged, though conditions may apply. Lenders may require a higher deposit or flood insurance proof before approving a loan. Insurers may charge higher premiums or apply exclusions based on the flood risk level. A broker can help you compare options tailored to high-risk properties.

What additional documentation or limitations apply when buying in a flood zone?

You may need a FloodWise Property Report, a surveyor’s flood level certificate, and engineering assessments. Some lenders will also request proof of insurability before settlement. Council restrictions may limit renovations or require raised building designs. Always review the property’s planning overlays and talk to a local broker before proceeding.

How much does flood insurance cost in Brisbane?

Flood insurance costs in Brisbane can range from $1,000 to over $10,000 annually, depending on the property’s location and flood risk. Homes in high-risk zones like Rocklea or Graceville attract the highest premiums. Premiums are also influenced by the type of flooding and whether the property has flooded before. Getting multiple quotes can help you save.

What happens when doors flood?

Floodwater entering through doors can cause structural damage, including warped frames, ruined flooring, and mould. It also damages electrical systems, furniture, and internal walls. Flood insurance typically covers cleanup and repair, but the process can be time-consuming. Always take photos and act quickly to minimise water damage.

What is the flood insurance claim process?

First, take clear photos of the damage and lodge your claim as soon as it’s safe. Your insurer may send an assessor to inspect the property. Keep receipts for temporary accommodation, repairs, and cleanup costs. The insurer will then assess and process your claim, which may take several weeks depending on demand.

Are there financial aid and government grants for flooded homes in Brisbane?

During major flood events, the Queensland Government and the Australian Government often offer disaster recovery payments and clean-up grants. These can include cash assistance, relocation support, and concessional loans. You can apply through the Queensland Government’s Disaster Relief portal or Centrelink for federal aid. Eligibility depends on your location, insurance status, and level of damage.

Speak To Our Team Of Experts Today

We are experts in getting home loans approved and work with several banks that can accept your home for a loan.

If you would like to chat about buying a home in a flood zone and need finance, speak with one of our experienced mortgage brokers to walk you through the next steps.

At Hunter Galloway, we help home buyers purchase properties that are in the flood zone. We also help you get ahead in this competitive market by giving you the actual strategies that have helped other homebuyers like you secure a property when there have been 5 other offers on the table!

More Resources For Homebuyers:

- 12 steps to research a house in Brisbane

- What is lenders mortgage insurance

- What is loan to value ratio?

- How to work out your usable equity

- Pay off your 30-year home loan 6 years faster

Ready to take the next step toward buying? We’re happy to help. Schedule a call today with a home loan expert from Hunter Galloway, the home of home buyers.

Start again

Start again